Investors look at a company’s cash flow statement to determine whether the company generates enough cash flow to pay debts, invest in growth and, ultimately, provide a positive ROI for investors. The statement of cash flows, along with the balance sheet and income statement, is required to be filed with the SEC when results of operation and financial condition are typically reported. Investors use this cash flow analysis to determine if the risk is worth taking. Smart investors are attentive to the vulnerabilities your statement can expose, so how can your business adapt its report to better address their needs and concerns?

The main elements of the cash flow statement

A cash flow statement is divided into three sections that describe the cash flows of the company.

- Operating activities: includes monies derived from business activities.

- Investing activities: describes the gains and losses during the reported period.

- Financing activities: details how funds were used for debt and equity obligations.

Each section will stand on its own in summarizing the cash inflows and outflows of the category, resulting in net cash flow values. The three sections are then totaled and may be adjusted for foreign currency fluctuations if appropriate.

Prepare your cash flow statement with the indirect method

There are two ways of formatting your cash flow statements: the direct or the indirect method. Investors will expect you to use the indirect method. While it is more time consuming to prepare, it will provide investors with greater detail about your cash management skills and your business’s growth needs.

Why is the indirect method preferred over the direct method? The direct method deducts only operating expenses that consume cash from cash sales—converting income statement items to a cash basis. In contrast, the indirect method makes non-cash item adjustments for accrued and deferred obligations, such as accounts payable and depreciation. If you have recently adopted accrual accounting, changing to an indirect cash flow presentation should be your next step.

Cash flow analysis: formulas and ratios

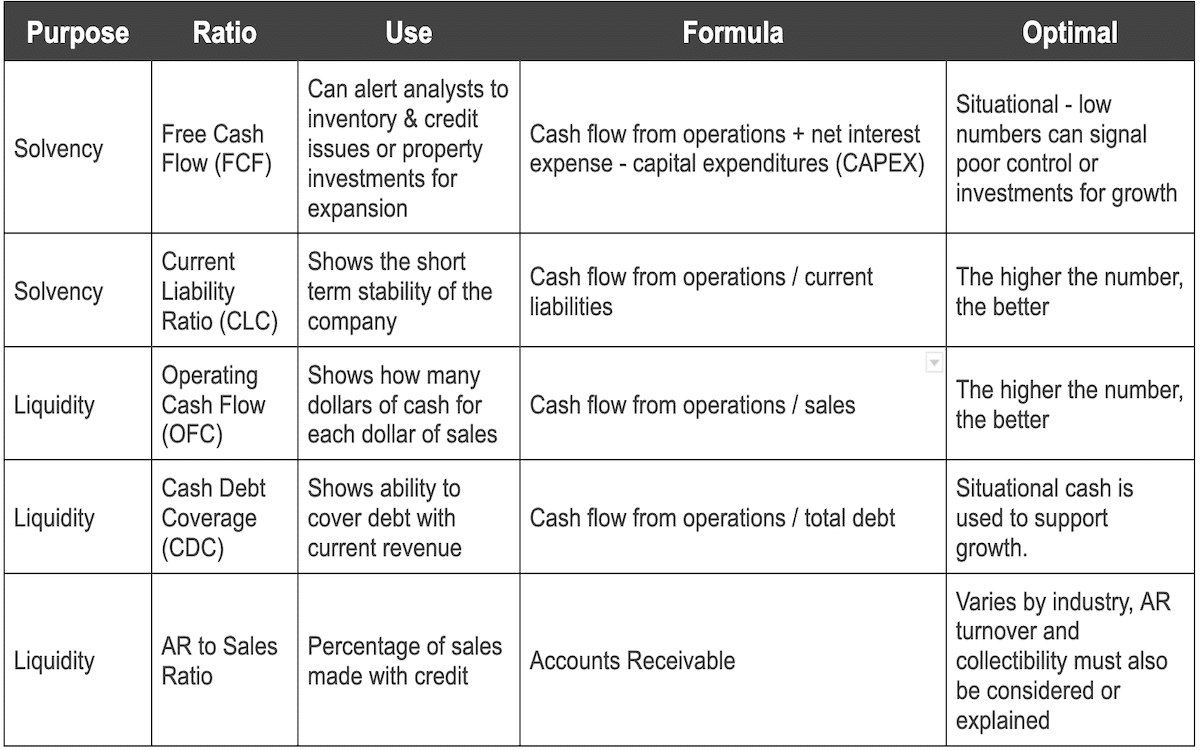

Circling back to the investor’s main objective, your cash flow statements need to show metrics that document the solvency and liquidity of your company. With them, investors can evaluate the risk and potential gains of investing in your business versus choosing to invest in other opportunities.

You may use variations of each formula depending on the intended objective, but the key ratios in this table will help you perform a deeper cash flow analysis in advance of your fundraising cycle. As with all ratios, they are most useful when compared with industry standards and when shown as trends over time.

Showcase your cash management judgment

Highlight your cash management and decision-making skills and demonstrate your transparency by preemptively addressing cash flow metrics that investors will calculate. That includes explaining any variances from industry or individual norms.

“Know your numbers” is sage advice given to entrepreneurs who plan to approach investors. While certainly savvy, the winners who receive funding go beyond reciting facts and figures. For example, by articulating that your low cash flow is due to CAPEX (capital expenditures) reinvestments used to grow your business, you can demonstrate your belief in your company and your grasp of the details that investors will call out.

Preparation yields rewards

Your cash flow analysis reveals important insights about your business acumen. Used in conjunction with other financial reports, it guides readers to understand your company’s profitability and how you choose to manage your profits. It also helps investors understand the risks and potential rewards of injecting capital into your business.

Owners and management teams that take time to run vertical and horizontal analysis (i.e., comparing items within reports as well as across time periods) will gain a two-fold advantage over those that neglect to do so.

- Doing so allows you to rehearse metrics results and explain variances from industry standards.

- Doing so gives you time to address controllable items, such as accounts receivable or debt service challenges, potentially months in advance of pitching to investors.

Preparation yields results, and standing out with the proper cash flow metrics and insights can help you secure funding to bring your company to the next step.

If your company can benefit from a thorough cash flow analysis or from improved financial reporting in advance of fundraising efforts, contact Paro to gain fundraising strategy from highly vetted, fractional experts that can help you raise capital and continue your path towards growth.