This blog also appeared on VentureApp, which saves businesses time and money finding the vendors they need.

The word “model” is often tossed around the business world, evoking complicated and intimidating visual images to those unfamiliar with them. But instead of depending on your “friend with an MBA” to back you up, any business owner can and should know the basics of financial modeling. So what is a financial model exactly? A model is a means of predicting the future, and like a meteorologist forecasting rain, a financial model is really just a volatile “best guess” that should be updated frequently. Models take a set of assumptions (and sometimes your business’s performance history) and forecast a future state. Even though they are predictions, models provide a good benchmark and can help run “what-if” scenarios so you are prepared for any situation.

To start, a model doesn’t have to be exceedingly complicated and can easily be created in a program like Excel. We’ve outlined the foundation of a basic model below as well as tips (like not neglecting your balance sheet) for maintaining it. Below are some financial modeling basics, but we’ll start with the 4 tabs that absolutely must be in your model.

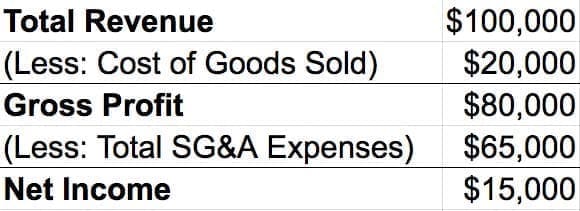

Profit & Loss Statements

A company’s P&L statement (synonymous with an income statement) tracks your revenues and expenses to determine your net income (also known as your bottom line). If you have historical financial statements, it’s wise to make sure your model matches those. If not, stick to the standard layout of a P&L as the output. The most basic layout should follow this format:

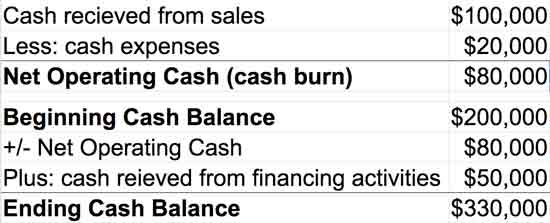

Cash Flow Statement

Often times, in smaller businesses with simple accounting, the net income from the P&L will be the same as the increase or decrease in cash for that period. However, a cash flow statement adds the element of projecting financing activities like business loans or capital raises. As financing activities do not hit your P&L (since they aren’t considered income), the cash flow statement is crucial to project potential future cash needs, burn rate, and run way.

Dedicated Personnel Tab

Typically the largest expense for any company is human capital. You need a place where you can accurately project out salaries, benefits, taxes, and raises. You also need to consider potential future employees as your business grows. Remember to include a start date to forecast when a new employee’s salary will be a realized expense on your P&L.

Dedicated Assumptions Tab

Often, people build assumptions into formulas or scatter them throughout a model. While convenient at the time, this can be confusing in the future when you are deciding which levers you can pull to test different scenarios. Having a dedicated assumptions tab keeps things organized and makes handing off the model to someone else easier, too.

Think carefully through your assumptions

- It is nearly impossible to accurately project future revenue, however, projecting costs is a different story

- To make a successful model you should rely on building out costs and the logic behind those costs (i.e what will cause them to increase or decrease)

- If you have solid logic behind how your costs grow in different sales scenarios, you can start to back into reasonable revenue projections

Nothing should be hardcoded

- The key to a useful model is one that can function as an interactive tool to play out a variety of “what if” scenarios and accurately adjust to changes in assumptions

- It takes a LOT of time to update hard-coded values if you want to test different scenarios such as faster growth in the first quarter of the year

- You’ll forget what to change! If your assumptions are not driven by some cost logic, you will likely forget what needs to be updated if you were to change a revenue growth scenario

Keep things organized

- Keeping your model organized is essential to making it a useful tool

- Even the most basic models will have enough assumptions, data points, tabs, and unique outputs making it difficult to remember where everything is and how everything works

- Consistent formatting and building out tabs that have a clear purpose will help you when you need to come back to your model to test a new hypothesis

It’s our hope that you now have a better understanding of what a model should include. Whether you are the CEO of a Fortune 100 company or an entrepreneur working out of your garage, build a sound financial model so that you aren’t making decisions in the blind.

As a final tip, be cognizant of your time and core competencies. If Excel isn’t your forte, consider finding someone to help you. What might cause you many nights of hair pulling frustration, would be a cinch to an experienced financial analyst and only take a few hours to build.