The income statement, also known as your profit and loss (P&L) report, will aid you in running your business and prepare you for the next level: fundraising. In addition to your balance sheet, your income statement provides valuable insights to investors and to your business. It can reveal underperforming sectors or the rock-solid upward trend you have been on for two years. To demonstrate your financial health, it’s crucial to prepare an income statement that aligns with your pitch and reassures investors of your value.

Know the terminology

As a business owner, you’re often likely to come across these terms and fundamental elements when reading your income statement. This quick primer will confirm your knowledge or point you to an area to explore further.

- Income Statement and Profit and Loss statement (P&L): These terms are synonymous. They show the revenue, expenses and profits during a given period.

- Cost of Good Sold (COGS): COGS are the expenses directly related to getting a product or service ready for sale.

- Depreciation: This is the method of reducing the book value of a physical asset over a period of time by expensing a portion of it each period. It represents lost value over time.

- Amortization: This is a similar process to depreciation, only with non-physical (intangible) assets where a portion of the total is expensed each period.

- Operating expenses: These are the expenses that are not directly related to the production of goods for sale. Examples include administrative salaries, research and development expenses, and marketing costs.

- Operating profit and Earnings before Interest and Taxes (EBIT): These terms are also synonymous. EBIT is a key metric. It represents the revenue and expenses that management have within their ability to control.

- Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA): This measures cash earnings before non-cash expenses. It is viewed by many investors as an indicator of future operating cash flow.

Step up your analytics

Any number on its own is rather meaningless. To gain information from it, you need to compare one value with another. Increase your funding potential by including vertical and horizontal analysis when you prepare an income statement. The insight these ratios provide will also help you in evaluating your financial position. If you do not provide ratios, investors will be doing their own math. That added step takes away their focus from thinking about your product and your company’s potential.

Including vertical analysis in your statement

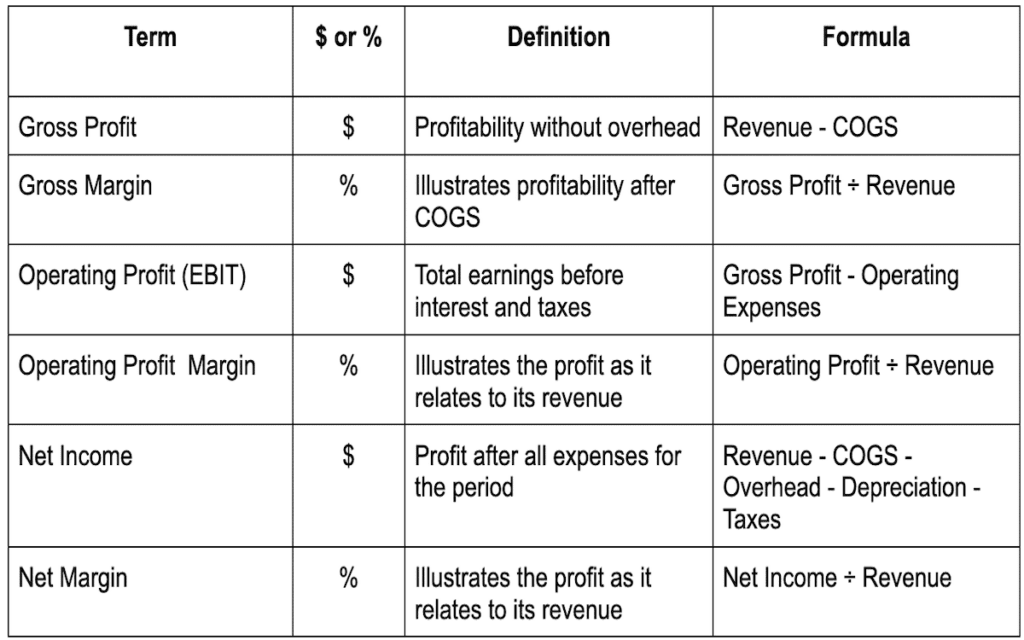

The table below defines income statement profit and income lines that are standard on most income statements. Adding their related ratios (margins) to the reports will allow investors—and your management team—to make comparisons with competitors, industry standards and other investment opportunities being considered.

Including horizontal analysis in your statement

Improve income statements by adding columns for different reporting periods in order to highlight trends and anomalies. Investors find horizontal analysis helpful when reviewing reports. The multiple reporting periods let them more easily identify fluctuations in revenues, expenses or specific line items.

Public companies: file with the SEC

Public companies are required to file financial statements with the Security and Exchange Commission (SEC). Audited statements are needed annually on form 10-K, and unaudited statements are filed quarterly on form 10-Q. Both income statement formats must include horizontal analysis.

When investors see financial statements that are prepared in accordance with SEC requirements or have traits similar to them, they see a mature management style. Companies also benefit by using these features to more easily assess their financial condition.

Additional tips as you prepare your income statement

Investors have many choices for deciding what to do with their money. Your job is to make their decision easy. These additional tips as you prepare an income statement will help investors see if your company is worth their capital.

- Fact check your perfect story. Make sure your story is in perfect alignment with what is shown on your financial statements. Preempt any concerns by bringing up indicators that appear to contradict what you say.

- Do the math for them, and show your work. Prepare printed or shareable documents with ratio analysis results and other metrics that are not embedded into your income statement.

- Drill down for the details. The income statement shows the total cost of goods for the period, but you may need to go deeper. Have supplemental information (e.g., the cost of goods for your key products) memorized and available for review.

- Go outside the lines. If sales revenue or marketing expenses catch their eye, you may be asked about your customer acquisition costs. Don’t think strictly of the numbers on the income statement report, but those that are affected as well.

- Expect skepticism. It is important to avoid getting rattled when your numbers are questioned. Income statements inherently contain estimates and assumptions, and the choices management made may not be the same that those with different experiences would make. Be open to input and appreciative of any insights that you are offered.

Power up the process

The effort you take to prepare an income statement and think like an investor will increase your chance of receiving the funding you desire. A healthy side-benefit of the activity is that you will have built additional metrics for understanding your own financial position, enabling you to make better business decisions each day.

If your company is poised for growth and is planning to seek outside funding, Paro’s financial reporting and strategic advisory solutions can offer the monthly financial reporting or fundraising expertise you need to raise capital.