No recent Supreme Court ruling has rocked the business world as much as the Wayfair decision that introduced sales tax nexus. The narrow 5:4 verdict on South Dakota v. Wayfair, Inc, et al opened a floodgate of responsibilities for businesses to collect and remit taxes on goods sold in far off states and localities despite having no physical presence there.

Small and mid-size businesses continue to struggle to make sense of, and comply with, their obligations for sales tax collection, filing and remittance.

What is sales tax nexus?

Simply put, nexus is a connection between two or more entities. Sales tax nexus is the point where a legal tax obligation begins. Businesses have always been responsible for collecting and remitting sales taxes in jurisdictions where they sell goods.

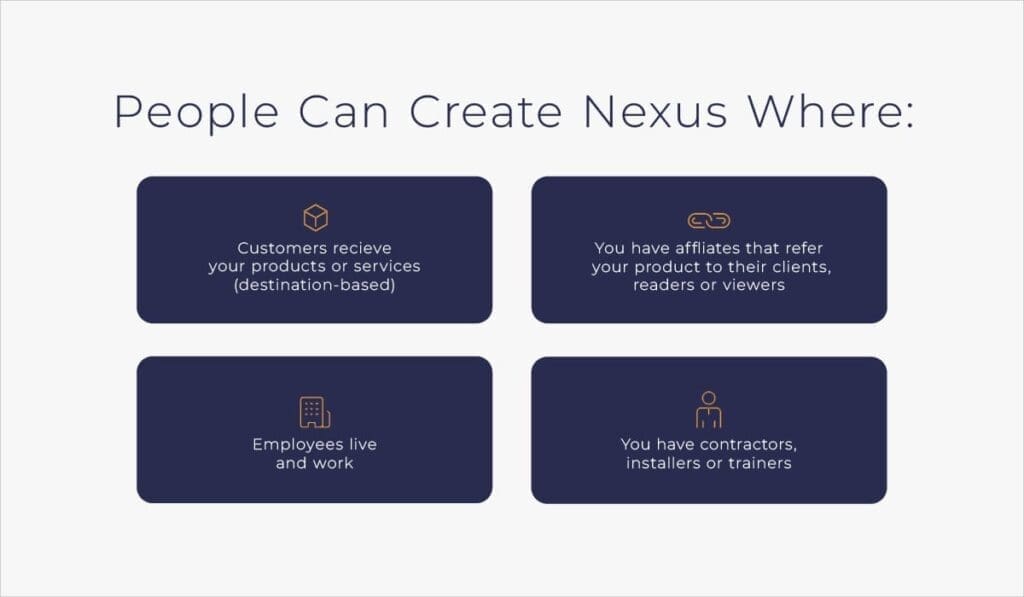

Wayfair exponentially expanded the tax landscape beyond the physical presence concept to allow states to create sales taxes liabilities based on economic nexus. The change taps into each leg of a product’s journey and permits taxing in states where goods are shipped, stored, enhanced or delivered.

What prompted sales tax nexus?

Wayfair, an online home goods retailer, heavily advertised and encouraged their customers to make tax-free purchases. Seeing this as a tax evasion strategy, South Dakota enacted an economic presence test in 2016 on out-of-state retailers. This made them subject to sales tax liability after $100,000 in sales or 200 transactions in the state.

Know your sales tax obligations

Use tax, excise tax, transaction privilege tax and many others fall under the umbrella of sales taxes. Rather than being federally regulated, each state’s Department of Revenue provides guidance for their expectations and the thresholds for meeting nexus.

First, you need to determine what tax obligation you have now, or may have in the future, for each state you:

- reside in

- do business in, or

- have a business connection with.

Once you have identified your obligations for each relevant state, you will need to:

- obtain a sales tax permit

- calculate and collect sales tax on the appropriate products or services

- file tax returns at the required intervals (monthly, quarterly or annually), and

- remit the collected tax to each state.

Five states do not have state sales taxes:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

That said, Alaska allows local and city taxes, and Montana permits them in tourist areas. Thus, you may still have an obligation to collect and track sales tax in specific locations.

Create a plan and streamline your process

As with all things under the accounting umbrella, staying organized is key. It’s essential to:

- Document your sales tax process.

- Add state sales tax filing and payment due dates to your office calendar.

- Give yourself ample time to collate the data, prepare the returns and remit the payments.

- Have resale exemption certificates in place if you are a reseller. This will reduce your tax obligations on goods you have purchased for resale.

If you need to get seller’s permits in multiple states, you can visit Streamlined Sales Tax Governing Board to see if filing collectively with their 23 member states is beneficial. Sales tax software companies such as Avalara, TaxJar and others can connect to your online platforms and ERP system to help you with calculating and filing sales taxes based on jurisdiction.

Be aware of nexus complexities

States have different thresholds before nexus is met. They also have tax holidays, exempt products and many other factors to consider. Items like medical supplies, food, clothing and cloud-based applications are taxed differently depending on where the purchase is made or received.

Within a state, products are often taxed concurrently by different jurisdictions. Sometimes, these have different filing guidelines and due dates.

Taxation of sales made at trade shows can also vary wildly. In some locations, nexus is triggered immediately, while others ignore it in favor of reaping the economic benefits the events bring.

If you make sales through marketplace sellers, such as Ebay and Etsy, be aware how each manages your tax obligations. If you use a Shopify website for direct sales, be sure to review their guidance and resources, including noting which states charge tax on shipping.

While marketplaces may remit the collected tax on your behalf, the gross sales should be added to your receipts from your own site and other platforms if you sell on multiple channels. This could create nexus that you had not previously considered.

Get support in the constantly changing tax landscape

The biggest challenge in considering sales tax nexus and your liability is that change is constant. Tax regulations will be updated, due dates will be changed, graduated nexus thresholds will update annually and tax amnesty programs will be implemented and expire.

With more than 11,000 tax jurisdictions in the United States, each of which may have their own guidelines, managing sales tax filing and payments can seem like a daunting task. Fortunately, meeting your sales tax obligation is within reach if you adopt a systematic approach for creating and monitoring filing thresholds, automate tasks when appropriate and provide diligent oversight.

If you are not yet fully compliant or need to assess whether your sales tax program can be more efficient, get help from Paro’s expert tax services. Our tax experts have the right mix of skills, credentials and experience to confidently evaluate your situation and help you implement best practices to manage and file your taxes accurately and optimally.