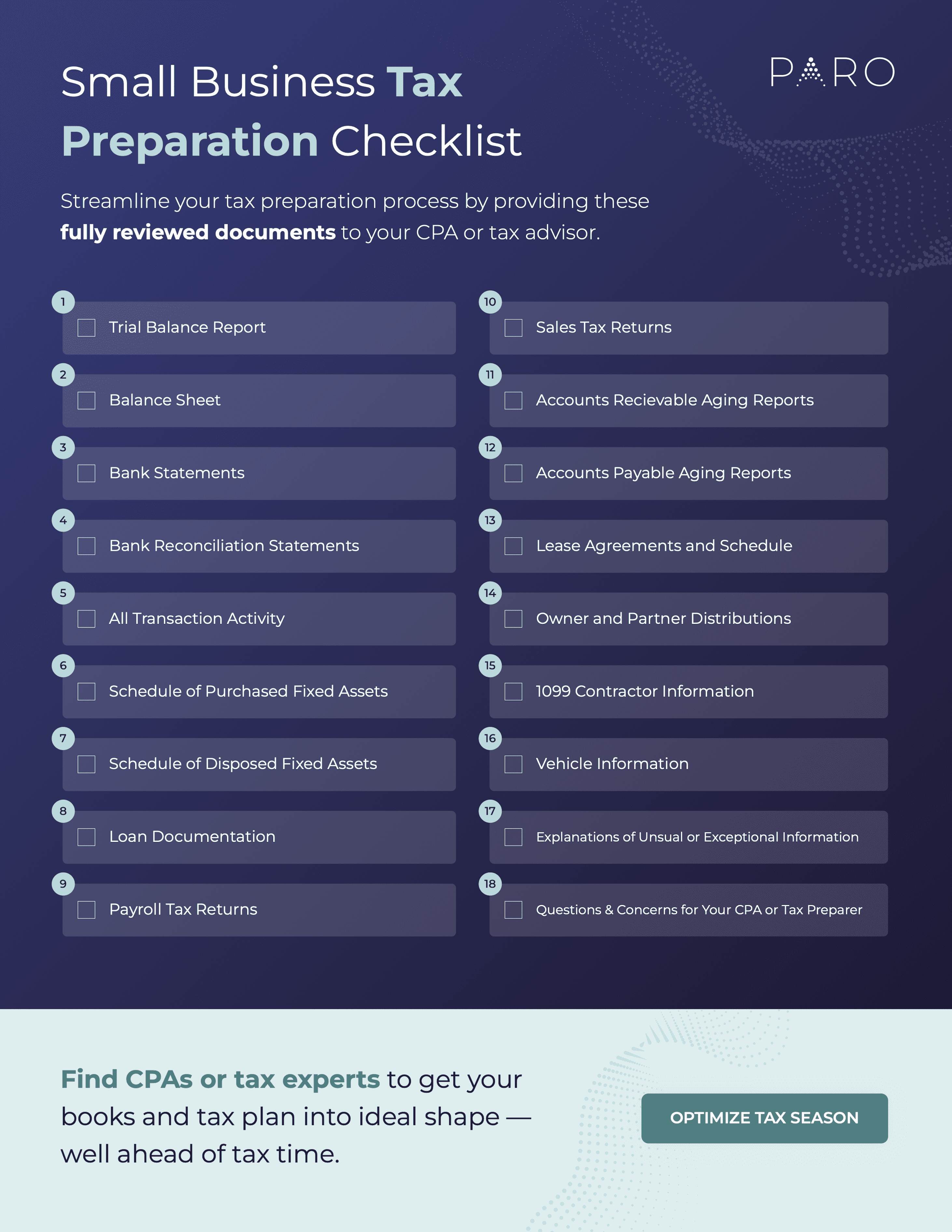

Don’t let tax season sneak up on you. From bank statements to payroll, there are a number of critical documents your tax preparer will need to report your company’s income and help you maximize your deductions and tax credits. The more thorough a picture you paint of your company’s financials, the more effective the process will be for you and your tax professional. Our small business tax preparation checklist can help.

18 critical items your tax preparer needs from you

Follow our tax preparation checklist above to ensure your tax preparer can accurately and efficiently file your business returns. You’ll need:

- A trial balance report that shows the final amount in each general ledger account as of the last day of the year.

- A balance sheet that shows the beginning and ending annual totals for each asset, liability and equity account.

- Bank statement copies for each account with the balance on the last day of the year. Include all credit union and investment accounts as well as online-only accounts, such as PayPal.

- Reconciliation statements for the full year for each bank, investment, credit card and loan account.

- All transaction activity in the form of an electronic download from your accounting software in an Excel or .csv format.

- A schedule of fixed assets purchased that lists:

- when each item was purchased

- cost at purchase

- whether it was new or used

- when it was put into service

- A schedule of fixed assets disposed that lists:

- when each item was purchased

- cost at purchase

- when each item was put into service

- when each item was removed from service

- how it was disposed (sold, recycled, discarded)

- funds received for each item

- All loan documentation, including:

- statements

- contracts or schedules indicating principal

- Interest

- escrow payments

- duration of loan with start and end dates

- Documentation for loans paid off, forgiven or deferred

- Payroll tax returns, including form 941, as well as all supplemental forms such as 8974 (research) and 7200 (employer credits due to COVID-19).

- Copies of all sales tax returns filed in each state throughout the year. (Review Paro’s sales tax nexus guidance if you operate in multiple states.)

- An accounts receivable aging report that lists all amounts owed to you separated in 30-day increments from when they were due.

- An accounts payable aging report that lists all amounts owed by you, separated in 30-day increments from when they were due.

- Lease agreements and schedule including copies of original contracts and addendums and a schedule of all leases. (Review Paro’s ASC 842 Lease Accounting guidance.)

- Owner and partner distributions, including records of all withdrawals, transfers and payments made.

- 1099 contractor information. If you issue these information returns, provide copies of each. If your accountant will be issuing them, provide all necessary details. (Note: The IRS now requires form 1099-NEC rather than 1099-MISC forms for non-employee compensation.)

- Vehicle Information, such as:

- make

- model

- year of vehicle(s)

- year-end odometer reading

- date put into service

- business miles logged (if partially used for business)

- type and weight of vehicle for depreciation schedules

- Explanations and notes regarding any unusual expenses or activities, significant changes in income streams, adjusting entries made and substantial variances from prior years.

- Questions and concerns for the tax preparer. Prepare bullet points of items you would like to discuss with your CPA or tax preparer. You should address potential business opportunities you’re exploring, lease versus buying decisions or anything else that may impact your current, prior or future tax position.

While every business is unique, this tax preparation checklist includes the elements that impact taxes that most businesses face. Save time and money by staying on top of your financial records and being prepared for your tax appointments each year.

If you need assistance with tax preparation for your annual tax appointment, contact Paro to be matched with a tax expert that best fits the needs and challenges of your business.