While inflation, economic headwinds and new policies impact business, a robust tax plan with the right tax minimization strategies can make a real difference in improving profitability and flexibility for the future.

Several pandemic tax relief programs have already concluded, but a few remain in effect through 2022. The Inflation Reduction Act of 2022 (IRA) provides some opportunities for tax minimization, but businesses must determine what actions to take now versus next year to reap the most benefits. Follow these five tax minimization tips as you close out the 2022 tax year.

1. Business Meal Deductions

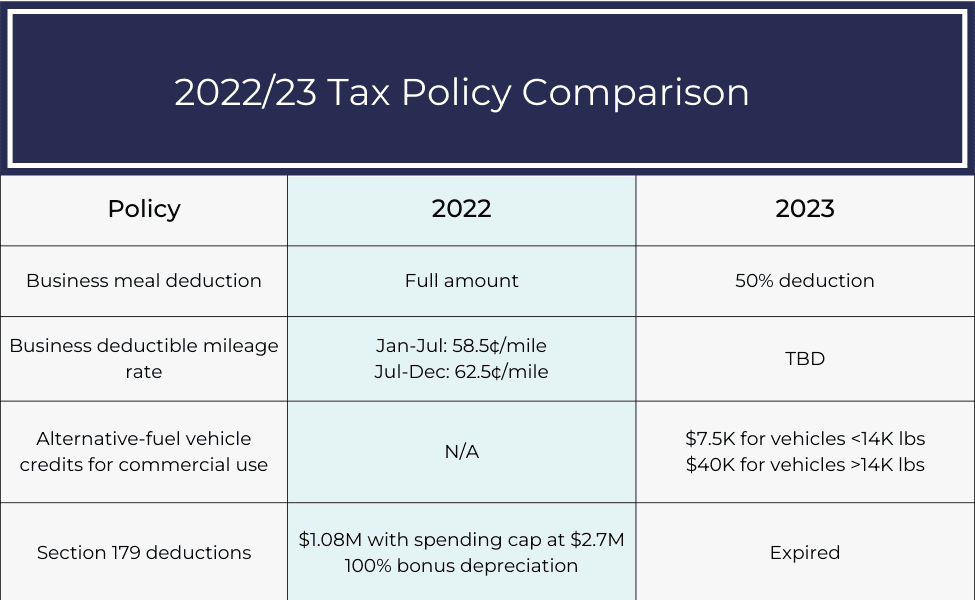

Through the end of 2022, business meal deductions are applicable for the full amount. The deduction rate will revert to its normal 50% rate in 2023. While meant primarily to help reinvigorate restaurant activity, these deductions also serve to reconnect you with your clients and network with prospects without impacting your bottom line.

2. Mileage Tracking

Short trips to the post office or to weekly networking events are often overlooked by many as unworthy of attention or documentation. While small items add up, with increased fuel costs, it’s especially appropriate. The IRS made an unusual announcement in June of a mid-year mileage rate change.

When using personal vehicles for business purposes, the deductible mileage rate for trips in July through December of 2022 is 62.5 cents, which is up from 58.5 cents for the first half of the year. If your employees complete expense reports, ensure the approvers have communicated the rate change and are spot checking reports to make sure the correct rates are applied.

3. Electric vehicle purchases

The Inflation Reduction Act (IRA) was signed into law on August 16, 2022. It expanded alternative-fueled vehicle credits to commercial vehicles beginning in 2023. The maximum federal tax credit is $7,500 for vehicles under 14,000 pounds, or $40,000 for heavier vehicles. In addition:

- Pre-owned vehicles will become eligible for the credits.

- Manufacturer thresholds are lifted.

- Vehicle prices are taken into account with the credits.

If you need to expand your fleet or purchase a single electric or hybrid vehicle, waiting until 2023 to make the purchase makes sense. Additional criteria, state, local and utility credits and incentives should also be considered within your tax minimization strategies.

4. Research Credits

Research and development (R&D) credits continue to provide opportunities for companies to offset some of the costs associated with product development. Think beyond software development and consider whether you use physical, biological, engineering or computer sciences in creation of a new or improved product. If so, you may be eligible for an R&D credit.

When updating budgets for 2023, factor in that you’ll be able to recoup research credits against both Medicare and Social Security tax beginning that year due to a provision in the IRA.

5. Accelerated Section 179 Deductions

Don’t overlook the benefit of expensing items in full rather than depreciating them over time. The 2017 Tax Cuts and Jobs Act (TCJA) allows businesses to claim immediate deductions on qualified purchases, such as software, computers and certain vehicles. The deduction reduces your net income, thereby reducing tax obligations during the year they’re taken. Some TCJA provisions will expire on December 31, 2022, so purchase items and put them into service in 2022 to take full advantage of this tax minimization strategy.

The deduction limit for 2022 is $1,080,000 with a spending cap on equipment purchases of $2,700,000, as well as the potential of using bonus depreciation at 100% for 2022.

Expertise to Guide Your Tax Minimization Strategies

One perpetual element of tax planning is incorporating the current state of your business and the economic climate into your plans as you approach the end of your calendar year. Keep abreast of industry trends, inventory and supply chain issues. Then, integrate those with your business strategy to inform your specific tax strategy.

Are you unsure of where to begin?

Paro provides flexible tax solutions, powered by remote experts with elite experience and specialized industry expertise. Save money for your business this tax year with the guidance of a fractional tax professional and develop the right tax minimization strategies for your business needs.